This is always a question I hear from new business owners: “How do I price my products easily?” Where do you start?

It starts with reliable financial reports. It’s either the one you already have, or those from your competitors. From these reports, you can use accounting to get on track for a profitable pricing strategy.

2 Easy Pricing Methods to Calculate Your Product Selling Price

How do you do this? There are two commonly-used methods to create those price tags.

1. Simplest Way to Price: Cost-Plus Pricing

This is the most common way to price your product easily. You simply get the total of all costs of producing one unit of your product or service.

What should be included in the cost of your product?

If you’re into manufacturing products, your costs will include all direct materials and labor needed to create the product.

On the other hand, if you’re a retailer or reseller, you will include only the amount you paid for the product.

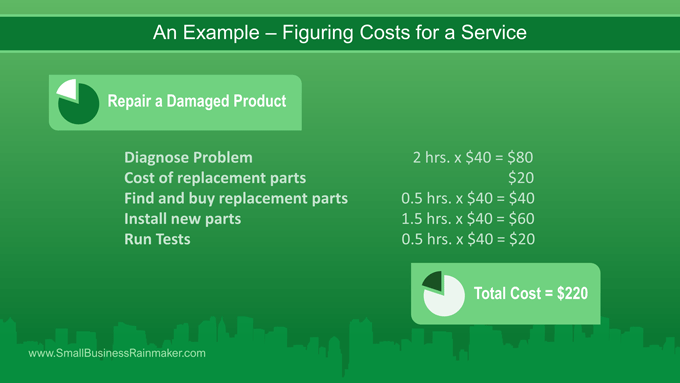

But, how about for services?

Determining the cost of services is a little tricky. Go through your service routine and the costs you incur along the way. The graphic below shows a hypothetical example of how to figure the costs of a repair service:

Margin will then be added to the cost of product (or service) to determine the appropriate pricing.

Examples of How to Calculate Cost-Plus Pricing:

Markup is the difference between a product’s cost and its selling price. Generally, depending on the industry, it is expressed as a percentage of cost.

Margin (also called Gross Profit) = Selling price – Cost of goods sold.

Margin and Markup move in tandem. For example, a 40% markup always equals a 28.6% profit margin, 50% markup always equals a 33% margin.

Using Markup

You have a business of creating wooden furniture chairs. You determined the following costs:

Wood costs: $100

Labor and materials: $40

Total Cost: $140

Desired Markup: 40%

Your selling price would be computed as: $140 X 140% = $196

In the example above, gross profit is $196 – $140 = $56.

Expressed as percentage: Margin is Gross Profit ÷ Selling price = .286 = 28.6%.

Using Margin

Using the example above, let’s say we want the selling price to give us a 40% margin.

Using simple algebra:

Selling price (SP) – Cost of goods sold = Desired Margin

1(SP) – $140 = .40(SP)

1(SP) – .40(SP) = 140

.6(SP) = 140

(SP) = 233.33

We’d sell it for $233.33. Our gross profit is $233.33 – $140 = $93.33.

Expressed as a percentage 93.33 ÷ 233.33 = 40%.

As you can see, the calculation for markup is a little easier to perform than the calculation using margin percentage.

But once you know what profit margin you want to achieve, you can always use the same markup calculation.

2. How to Price your Products with Target Costing

Target Costing is the opposite of Cost-Plus pricing. Instead of starting from the costs to determine the price, here you start with the market prices in order to determine the limit of the cost you can use to create the products.

How do you determine the market prices?

Use the average. In this digital age, it’s so easy to snoop around the online stores of competitors. From there, you can get a rough estimate of how much the average market prices are.

If you have a unique product, consider similar products. Otherwise, you will become a price maker, that is, you can dictate the price in the market.

From the market price, deduct your desired profit margin, and then the remaining portion will be your target cost.

Example of How to Price Your Product with Target Costing:

You have a business where you make dog cages. The average market price is $200 in your area. What should be your target cost?

Average Market Price: $200

Target Margin: 50%

Target Cost: $100

Therefore, the maximum amount you can use to produce each product is $100 only. Spending more than $100 will reduce your desired margins.

But, how much margin?

There is no fast and easy way of determining the appropriate margin. In general, however, a margin of 40-50% is the standard.

There are those that use the Price Multiplier Method. They simply multiply the total costs by 2 (100% markup or 50% margin) or by 3 (200% markup or 67% margin) in order to determine the mark-up they will put on their products.

You should also consider if your product is unique or not. If your product is unique, meaning there are no clear substitutes for it, you can charge a higher margin.

Otherwise, you are limited by how much the market can bear. The more common your product is, the lesser margin you can place on your prices.

If you’re into retail prices, you can check out the Suggested Retail Price of the manufacturer. This is usually the easiest and safest way to price your products. You just go with the prices, knowing that other businesses selling the same products have the same price tags.

Once you determine the right margin, you can price your products easily.

Conclusion - Still Too Complicated?

There are several other pricing computations, but they are more complicated than this. But, what’s a business without challenges? At least now you are more knowledgeable about pricing your product. Improper pricing could spell doom in your business.

The best pricing tip for new small businesses is to start with simple methods of pricing. Use the methods we discussed above. Change your pricing method only when you become more knowledgeable about your business environment.

If you’re unsure about what to do, you should ask for help from qualified professionals. Licensed accountants can help you price your products easily.

Be sure to check out our specially designed Profitable Pricing Methods for Small Businesses. It outlines a step-by-step blueprint to setting and getting the best prices for your products and services.

Our guest author, Gene de la Cruz, CPA, is a finance professional who helps website owners increase their traffic through well-crafted written materials. He has more than five years’ experience in accounting, teaching, and freelancing.

![How to Calculate Customer Acquisition Costs [Formula and Infographic]](https://www.smallbusinessrainmaker.com/hubfs/images/Blog/customer-acquisition-cost-formula.png)

Leave a comment